Individual Presentation

Gamma Investment Program

Macro, Equity, and Economic

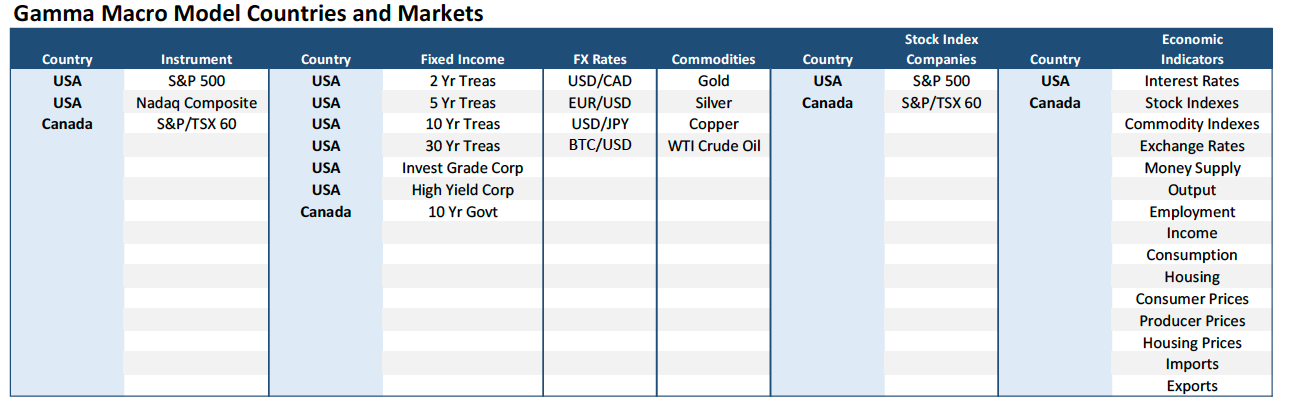

- The Gamma Investment Program is our institutional suite of forecasting and research products for the major developed and emerging economies covering stock indexes, bonds, individual equities, currencies, commodities, and economic conditions (Table 1).

- The Program is based on our Gamma Global Macro Model, a proprietary, fundamentally-based, nonlinear econometric algorithm that has accurately predicted major trends and inflection points for over 35 years.

- The Gamma Program delivers objective, unbiased, data-driven financial and economic forecasts, investment recommendations, analysis, and research tools needed to preserve and grow wealth.

Gamma Investment Program Features

Analysis and Indicators

- Gamma Macro, Equity, and Economic Intelligence Reports ®

- Concise monthly summary and analysis of Gamma Global Macro Model forecasts and investment recommendations

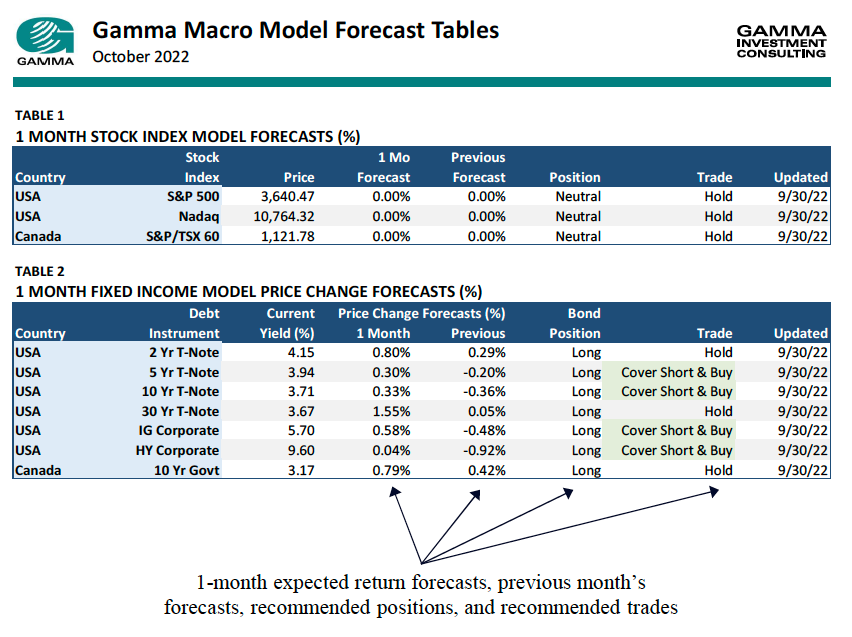

- Directional Forecast Indicator Tables and Charts

- Monthly expected return forecasts and recommended trade and position recommendations

- Valuation Indicator Tables and Charts

- Proprietary valuation indicators for all Gamma Global Macro Model markets including valuation-based expected return forecasts

- Behavioral and Sentiment Tables and Charts

- Sentiment-based expected return forecasts.

- Long-Term Economic and Financial Forecasts for the United States and Canada

- Economic and Financial Reference Tables and Charts for the US and Canada

- Intramonth Updates and Periodic Analytical Papers on Major Economic and Financial Topics.

Gamma Intelligence Reports®

Macro, Equity, and Economic

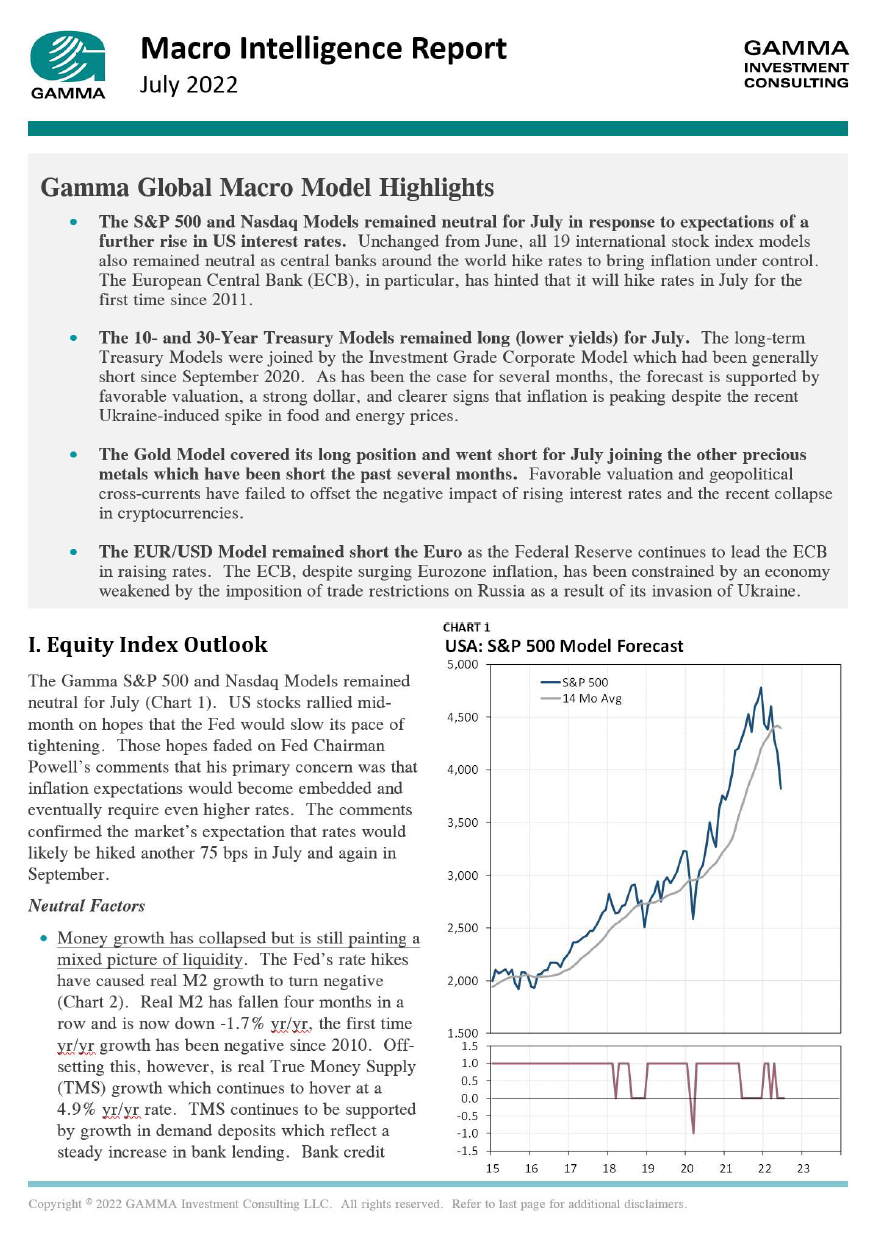

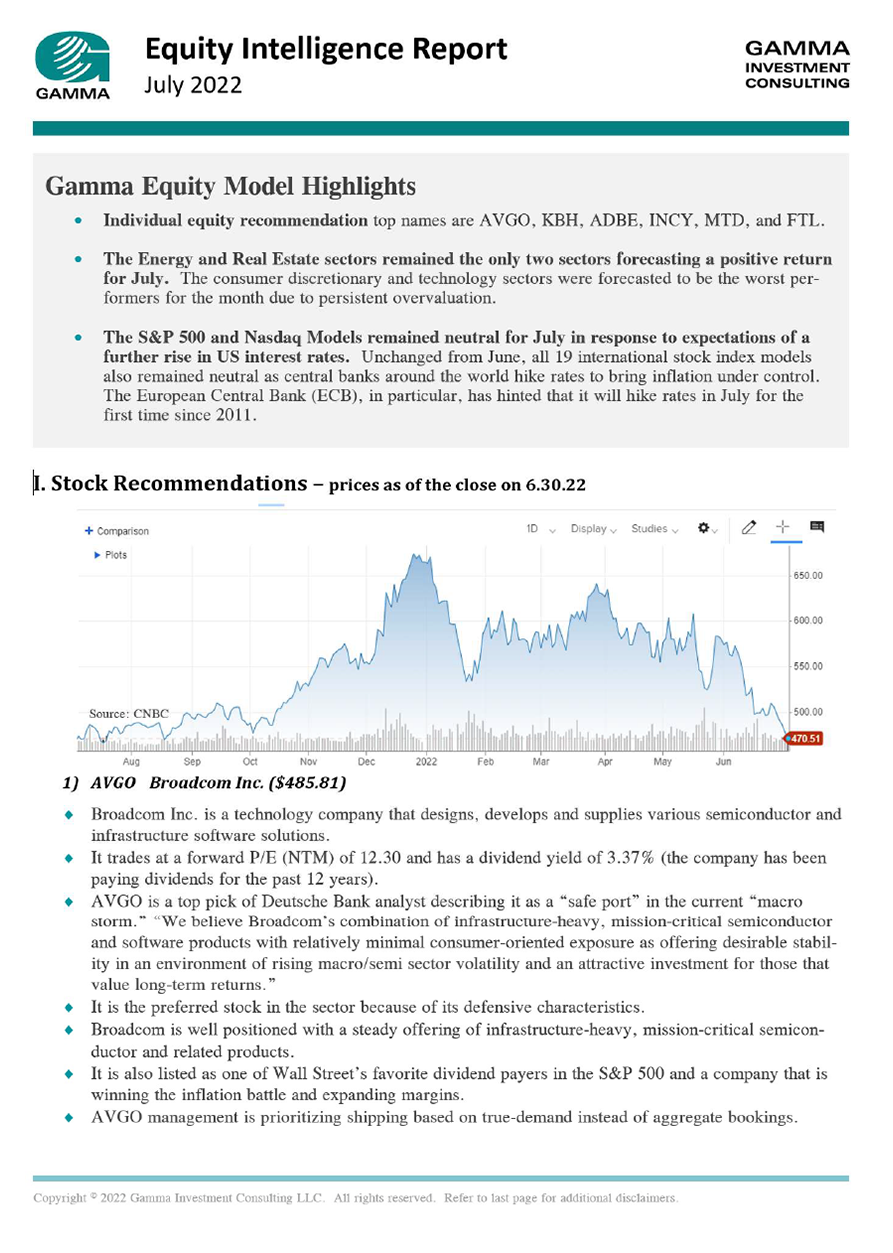

- The Gamma Intelligence Reports® provide a concise monthly summary and analysis of forecasts and investment recommendations from the Gamma Global Macro Model

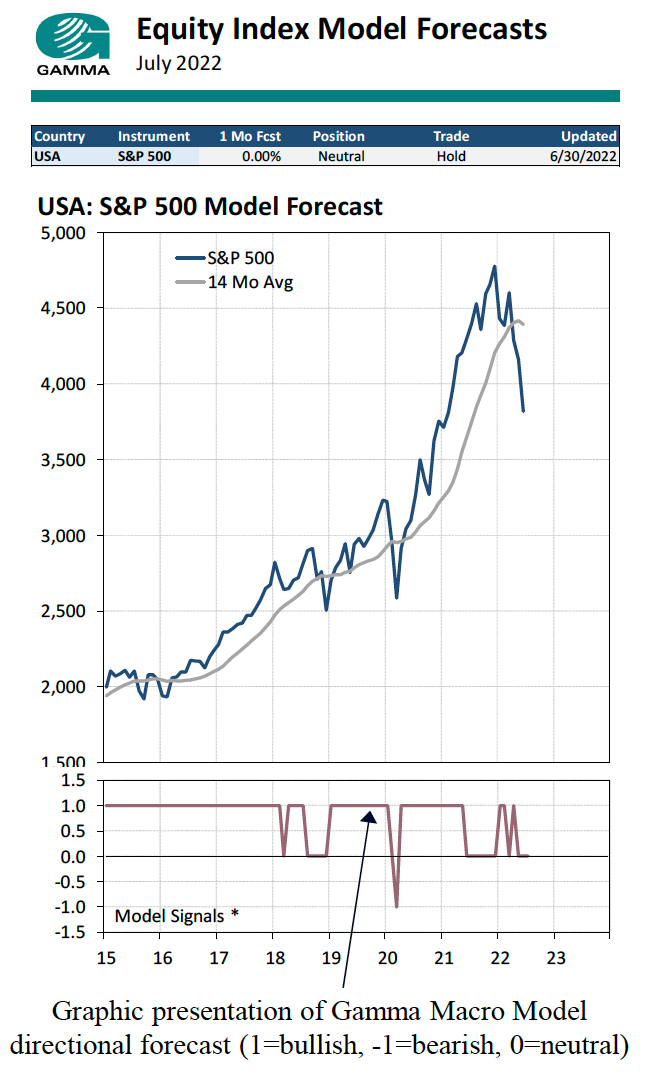

Gamma Macro Directional Indicators

Expected Return Forecasts and Recommended Trades

- The Gamma Global Macro Model generates one-month-ahead expected return forecasts and investment recommendations for all the major asset classes. Forecasts are summarized in tables and charts showing the direction of the signal.

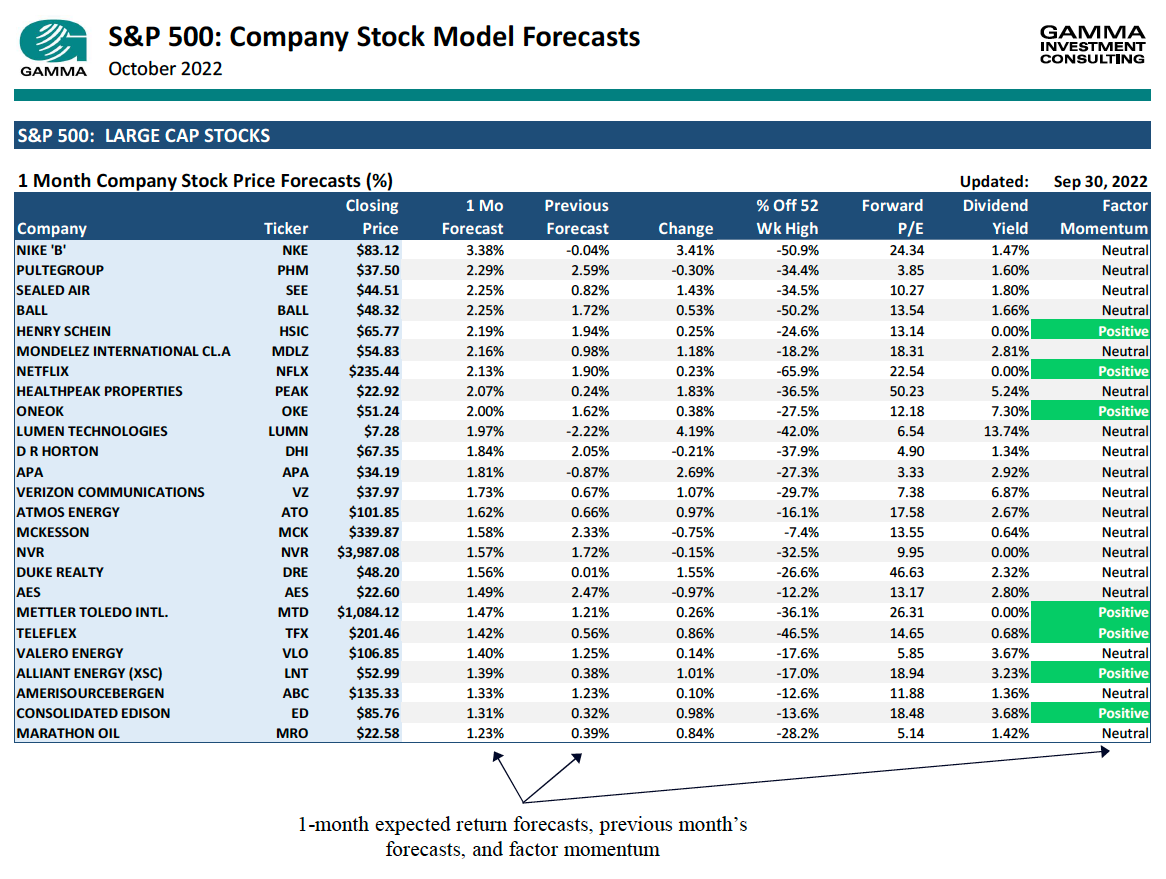

Gamma Equity Forecasts

Forecasts and Analysis of Companies, Sectors, and Indexes

- The Gamma Global Macro Model generates expected return forecasts for companies in the S&P 500 and S&P/TSX 60.

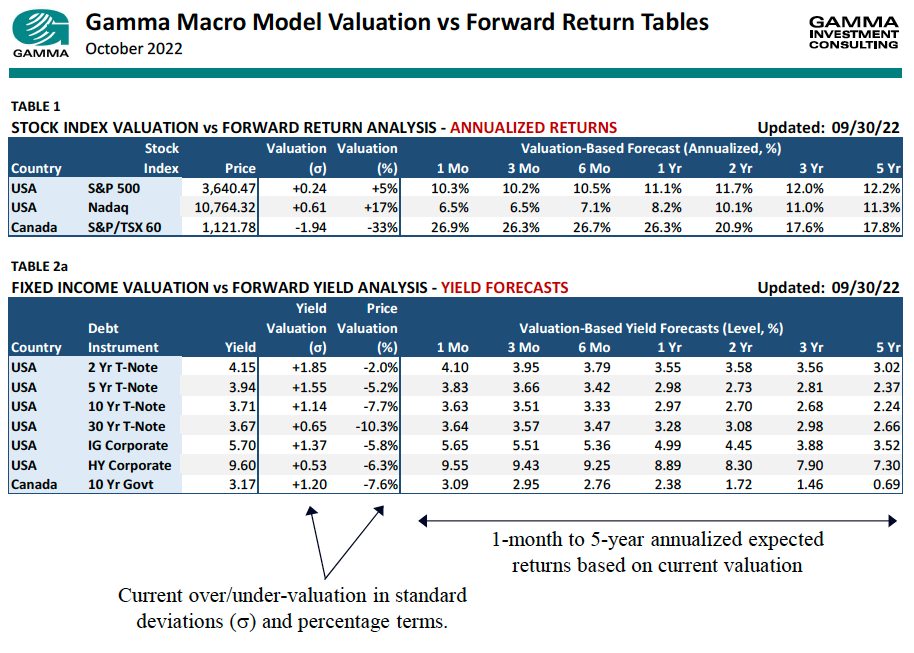

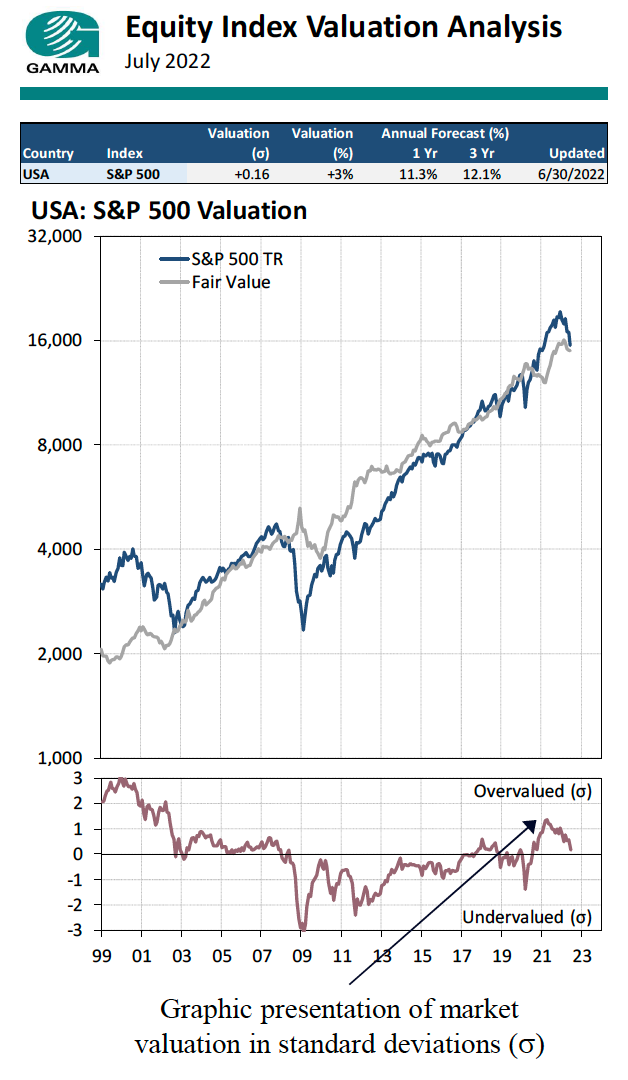

Gamma Valuation Indicators

Valuation Measures and Valuation-Based Expected Return Forecasts

- Proprietary measures of market valuation and 1-month to 5-year expected return forecasts based on current valuations. Measures and forecasts are summarized in tables and charts.

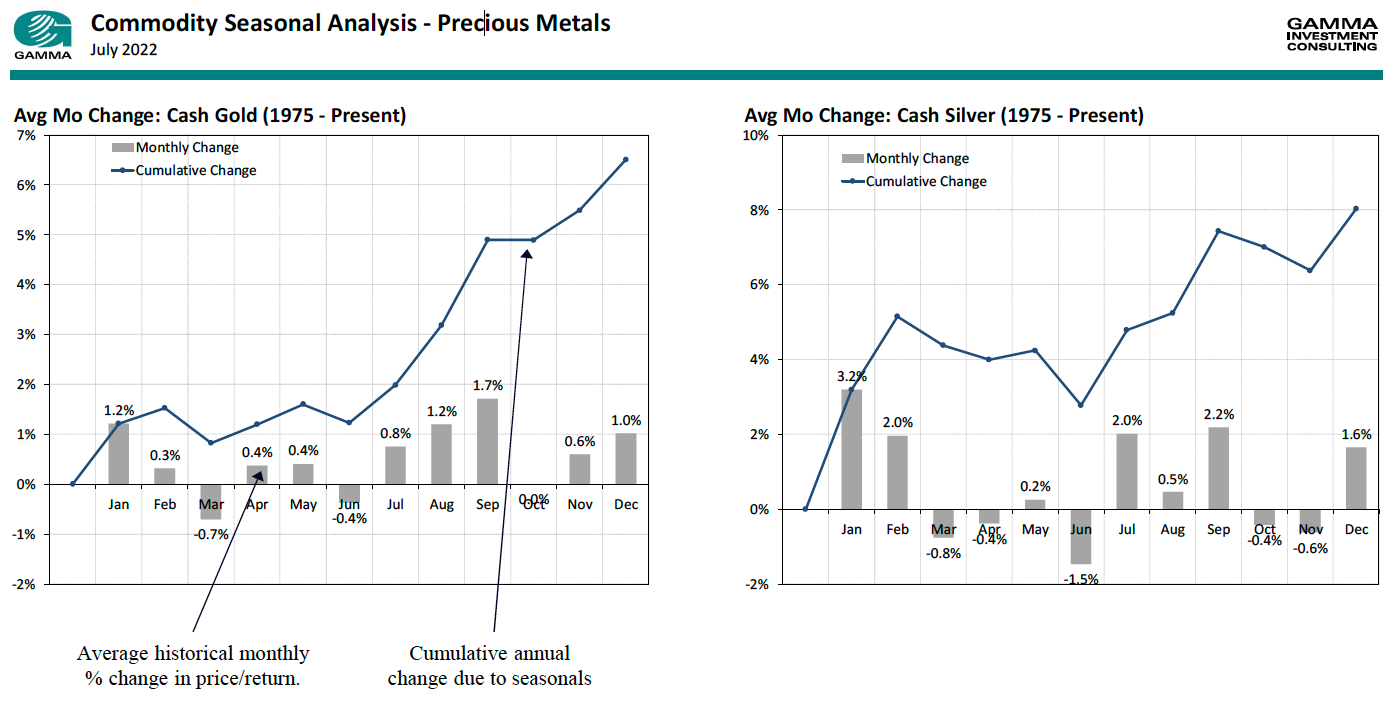

Gamma Seasonal Analysis

Seasonal Measures of Monthly and Annual Price Changes

- Charts of average monthly changes and their effect on cumulative annual returns.

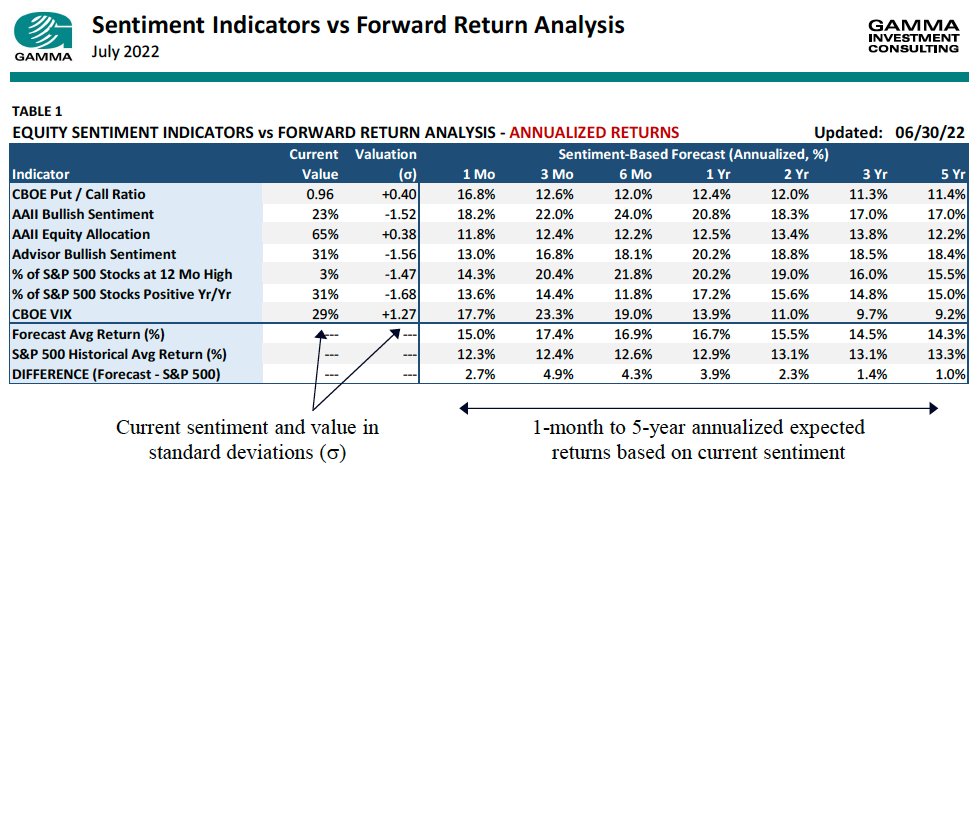

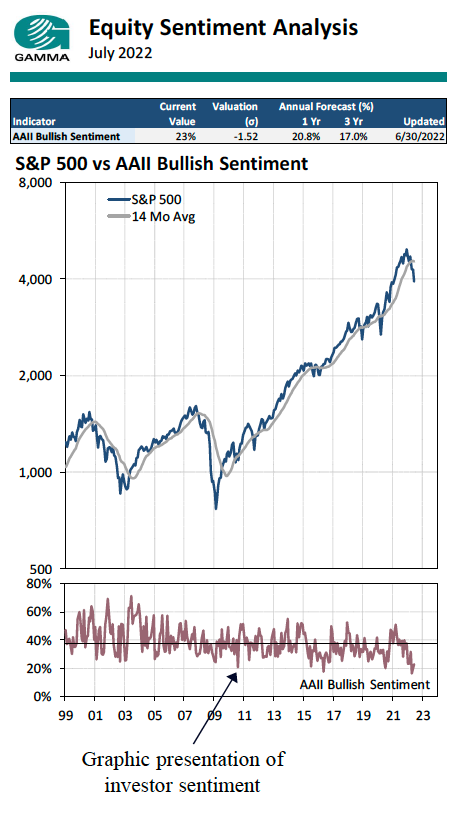

Gamma Sentiment Indicators

Sentiment Measures and Sentiment-Based Expected Return Forecasts

- Behavioral measures of investor sentiment and 1-month to 5-year expected return forecasts based on current sentiment. Measures and forecasts are summarized in tables and charts.

Gamma Economic Indicators

International Economic Forecasts

- Long-term economic forecasts covering interest rates, stock indexes, exchange rates, price indexes, output, employment, consumption, and investment for the major developed and emerging economies. Measures and forecasts are summarized in tables and charts.

Gamma Investment Consulting Principals

Karl V. Chalupa is the CEO and Co-Founder of Gamma Investment Consulting and Editor of the Gamma Intelligence

Reports. He is also President of Gamma Capital LLC, a quantitative global macro investment firm. Mr. Chalupa developed

the Gamma Investment Program used for previously trading the firm’s $400 million global macro program. He was

previously Director of Risk Management at Titan Advisors LLC, a $4.5 billion alternative investments firm. Mr. Chalupa

was also Managing Director of the Currency and Alternative Investment Strategies Groups at State Street Global Advisors

(SSGA) where he developed a $9 billion currency overlay program and launched SSGA’s first hedge fund based on his

Gamma Model. Mr. Chalupa spent 13 years at ABN Amro Bank where he traded interest rate and currency derivatives and

was Manager of the Proprietary Trading and Economic Research Desk. He began his career as an economist for the Federal

Reserve Bank of Chicago. Mr. Chalupa holds an MA in Economics from Brown University, graduated magna cum laude

from Northern Illinois University with BAs in Economics and Political Science, and is Series 3 registered.

Nicholas “Claude” Colabella is the Chief Operating Officer and Co-Founder of Gamma Investment Consulting and Co-

Editor of the Gamma Equity Intelligence Report. He was previously Director of Communications and Investor Relations at

Titan Advisors, LLC, a $4.5 billion alternative assets solutions firm. Mr. Colabella has equity research experience working at

Petroleum Research Group, Inc. (Rye, NY), an independent energy equity research boutique and at John S. Herold, Inc., a

leading petroleum research and consulting firm. He was a Managing Partner at Alpha Beta Alternative Investments, Inc., an

alternative investment boutique that managed Alpha Beta Partners, LP, a multi-strategy “fund of funds”. Mr. Colabella holds

an MBA in Finance from Duke University, Fuqua School of Business. He graduated magna cum laude from Manhattan

College, with a BS BA in Economics.