Our Philosophy

Karl V. Chalupa

It’s All About Risk

Before discussing what the Gamma Investment Research Program is, let’s discuss what it’s not. It’s not a “get-rich-quick” scheme. It doesn’t promise 1,000% returns. It doesn’t promise to pick the next Apple or Amazon at $2 a share (except, perhaps, by accident). Advisors who do are either lying to themselves or to you.

Why? Because beating the market is HARD. Millions of investors spend billions of dollars each year looking for an investing “edge.” That ensures that markets are generally “efficient” in the sense that unexploited low-risk profit opportunities are quickly taken advantage of and eliminated.

So, what exactly does it mean to “beat the market?” Consider two investment managers. Manager A makes an average return of 10% a year but also experiences a 10% loss every 3-4 years. Manager B makes the same 10% a year but suffers a 20% loss every 1-2 years. All else equal, which is the better manager? Most people would say Manager A. Why? Because he makes the same return as Manager B but with less risk (a 10% loss every 3-4 years vs a 20% loss every 1-2 years). The reason why risk matters is that Manager 2 is more likely making his 10% average return due to luck rather than skill – and luck runs out.

Many managers produce higher returns than “the market.” That doesn’t mean, however, that they are “beating the market.” “Beating the market” means generating a higher, statistically significant return relative to a passive benchmark(such as the S&P 500) when risk, transaction costs, and management fees are taken into account. This “higher, statistically significant return” is called “alpha.” Alpha is the goal, but because markets are generally efficient, it’s hard to produce. Extensive research indicates that only a very small percentage of investment managers and advisors statistically outperform passive investing when risk and fees are taken into account1. And these are the “best and the brightest” of the investment world!

The implication is that risk matters – a lot. Most investment managers and advisors focus on returns. But high returns can be generated with concentrated positions, leverage, and luck. All three inflict serious damage on a portfolio when the market turns against them.

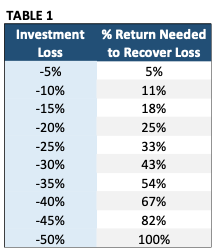

Controlling risk is essential to successful investing for two reasons. First, large losses cost time. Time is the one thing that an investor can’t get back, and time is critical to investment success due to compounding. Table 1 illustrates how large a return you would need to make on the remaining capital to get back to a “break-even” after a given loss. The larger the loss, the greater the gain needed to recover. The investment is not compounding new, additional returns during the time spent recovering.

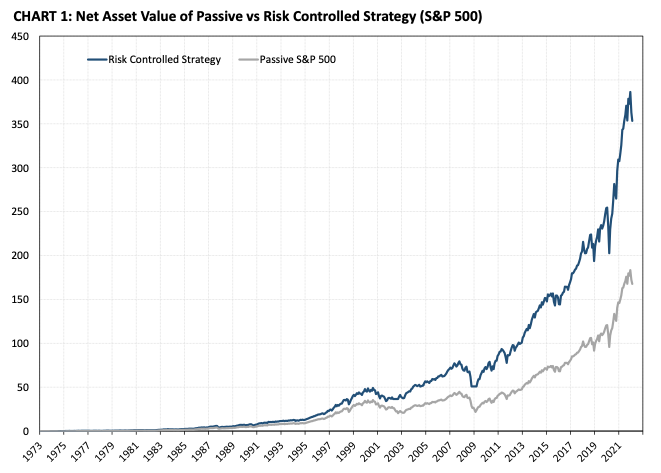

To illustrate this effect Chart 1 compares the cumulative total return of the S&P 500 since 1973 (which suffered 45%+ losses in 1974, 2002, and 2009) to a simple active strategy that reduced the 45%+ losses to a maximum of 25% each.

By simply reducing the three worst drawdowns of the past 50 years to 25% losses (which for most investors would still have been painful), the cumulative compounded return over 47 years would have been 2.1 times higher than the purely passive strategy (which most active managers do not outperform). This 2.1-fold outperformance would have occurred without picking one superior outperforming investment!

The second reason why risk control is so important has to do with emotions and behavioral biases. Numerous studies show that human beings are not entirely rational when it comes to investing. They are subject to a number of biases that cause them to incorrectly value and time investments. These biases are worsened when losing money. The fear of loss encourages emotional rather than rational thinking which can cause even larger losses and missed opportunities. Avoiding large losses in the first place reduces the risk of irrational decision making that can compound losses.

In addition to helping control market risk, Gamma Investment Research also helps investors avoid indirectly introducing other sources of risk that needlessly reduce returns:

- Short term trading is a highly specialized activity that most nonprofessional (and most professional) investors are rarely successful at when taking into account risk and trading costs. The vast majority of investors, both individual and institutional, are best served by focusing on long-term strategies that emphasize risk control.

- True alpha strategies can often take years to prove themselves. Investors should stick to consistent time-proven strategies rather than jumping around between the “latest and greatest.”

- Be wary of complex strategies and instruments. There are thousands of factors that potentially drive markets but only a small number have been accurate and reliable over the long run. Also, options, futures, and swaps have a place in an investment portfolio, but their complexity and potential leverage introduce risk that requires expertise and close monitoring.

- An optimally diversified portfolio of uncorrelated assets can dramatically reduce risk without reducing return. The markets offer diversifying opportunities for free. Use them.

Controlling risk is not “sexy” like picking the next Google, but the Gamma Research understands that it is absolutely essential to investing success. By focusing on risk, the returns will take care of themselves.

Gamma Global Macro Model

What Is It and How Does it Generate Alpha?

Gamma Investment Research is based on the Gamma Global Macro Model. The Model is a collection of quantitative algorithms and analytical tools for predicting the performance of international stock indexes, individual equities, bonds, interest rates, exchange rates, and commodities. Forecasts and analytics are based on a unique nonlinear quantitative methodology developed by Mr. Chalupa that has been in use for over forty years. The Model uses a key, core group of fundamental economic, financial, and behavioral indicators and unique insights into investor behavior that have proven to be highly accurate and consistent in predicting prices. Also, unlike most forecasting approaches, the Gamma Global Macro Model explicitly recognizes that markets behave much differently during periods of high volatility and extreme valuation. This aspect of the Model makes it particularly accurate when predicting major market reversals.

Why a quantitative approach?

Gamma Investment Research is based on the Gamma Global Macro Model. The Model is a collection of quantitative algorithms and analytical tools for predicting the performance of international stock indexes, individual equities, bonds, interest rates, exchange rates, and commodities. Forecasts and analytics are based on a unique nonlinear quantitative methodology developed by Mr. Chalupa that has been in use for over forty years. The Model uses a key, core group of fundamental economic, financial, and behavioral indicators and unique insights into investor behavior that have proven to be highly accurate and consistent in predicting prices. Also, unlike most forecasting approaches, the Gamma Global Macro Model explicitly recognizes that markets behave much differently during periods of high volatility and extreme valuation. This aspect of the Model makes it particularly accurate when predicting major market reversals.Most investment advisory services in our experience use a subjective, “narrative” approach. This approach is popular because many investors are more readily swayed by a compelling story than the dispassionate analysis of data. Speculation based on unquantifiable future economic and political events makes interesting reading, but generally offers few specific, actionable recommendations.

The Gamma Global Macro Model takes a different approach. Forecasts are based solely on the mathematical and statistical analysis of known data. The Gamma Investment Research uses quantitative analysis due to certain advantages over more subjective methods:

- Hypothesis testing. Expressing economic relationships and investment ideas in mathematical terms makes it much easier to rigorously test how valid these ideas are over time and under different conditions. It also makes it possible to identify, out of the thousands of factors that affect markets, which have historically been the most accurate and reliable in predicting markets.

- Handling large data sets. The human mind is well suited for identifying patterns in data, but it is not well suited for analyzing large, complex data sets. The human brain has developed heuristic “rules of thumb” that are useful for “fight-or-flight” decisions but are often useless when faced with complex relationships, huge amounts of data, and unknown probabilities. In contrast, computer algorithms are ideally suited to this type of analysis.

- Rules and relationships defined by a set of equations can be applied objectively and consistently over time and in different circumstances. This helps remove the adverse effects of emotion and other cognitive and behavioral biases on investing decisions.

Why fundamental analysis?

Quantitative analytical techniques are broadly divided into ones that use historical prices (“technical analysis”) and those that use indicators of supply and demand (“fundamental analysis”) to predict prices.

Technical analysis is inherently limited by the small amount of predictive information in historical prices. Investors constantly analyze thousands of pieces of data in search of a forecasting edge. The end result is an efficient market in the sense that unexploited, low-risk profit opportunities are quickly eliminated. Market efficiency implies that all known publicly available information is quickly built into the market price. It follows that historical prices, which are available effectively for free to everyone, should have little or no value for predicting future prices (which tends to be supported by numerous academic studies).

So why is a fundamental data any better? After all many academics make the same argument about economic data as they do about historical prices. The same millions of investors looking for an edge are presumably looking at economic data too, not just historical prices. Shouldn’t that fundamental data also be quickly incorporated into the market price and thus have little or no predictive value? The definitive answer is “maybe.”

Fundamental data differs from historical data in one important respect: it costs a lot more. A basic database of timely economic and financial data can cost tens of thousands of dollars a year, and the more useful the data, the higher the price. A database covering in-depth company information and more exotic data such interest rate swaps, credit default swaps, exotic options and high frequency data can run hundreds of thousands of dollars a year. For large institutional investors that cost may not be prohibitive, but it is for most individual investors and even many moderate size institutions. As a result, many investors only get pertinent information hours, days, or even weeks after it’s released.

Getting the data, however, is not the only issue. The bigger question is what to do with it? Markets are complex discounting machines that process and incorporate huge amounts of information. But what information is relevant? How do you know it’s relevant? How do the data series interact with each other? Over what time horizon? Our experience is that most nonprofessional investors do not have the time, inclination, or expertise to develop investment strategies that are likely to outperform passive approaches.

That is precisely why fundamental data has value. Its associated cost ensures that new information is only gradually, rather than instantaneously, incorporated into the market price. The Gamma Research is designed to quickly access new, relevant information, optimally analyze it, and generate accurate forecasts that produce meaningful alpha.

Behavioral Bias, Market Phases, and Alpha Generation

The use of fundamental data gives the Gamma Global Macro Model a forecasting edge compared to many other investment strategies. It is not, however, the Model’s primary and most important edge.

Over the last few years, a new study of markets has emerged called behavioral finance. Traditional finance assumes that investors are always rational, i.e., they behave purposefully to maximize their wealth through the complete, correct, and unbiased discounting of all relevant information. In contrast, a growing number of academic studies highlight cases where prices deviate from their theoretically rational levels more than can be explained by traditional finance.

Behavioral finance suggests that there are psychological and sociological limits to rational behavior. Among these are:

- Conservatism bias: the failure to rationally update expectations based on new information.

- Confirmation bias: rejection of new information that conflicts with prior beliefs.

- Anchoring and adjustment bias: the failure to rationally update expectations due to attachment to an arbitrary initial price.

- Self-attribution bias: unjustified confidence in one’s ability to forecast. A common example of this is emphasizing past winning trades while downplaying losing trades.

- Hindsight bias: past events are often viewed as more predictable than they actually were. As a result, rules and expectations derived from historical analysis are held too inflexibly.

- Anchoring to stories: human thinking is generally not quantitative. A story or narrative is often more compelling than the rational analysis of a situation.

- Extrapolation bias: the belief that recent events will persist even in the absence of economically significant news.

- Small sample bias: the formation of irrationally strong beliefs based on statistically insignificant data sets.

- Failure to learn: repeating the same mistakes and relying on heuristic “rules of thumb” that cause errors to persist.

- Herding: the formation of expectations based on the actions of other investors rather than independent analysis of information. Herding behavior slows the diffusion of information which can cause nonrandom persistence in price movements.

These irrational behavior patterns imply that markets may offer exploitable profit opportunities. On the other hand, numerous academic studies show that markets tend to be efficient, a point that is reinforced by the small number of investment managers that outperform over time. So, what’s really going on? Is generating alpha a realistic goal or not?

The market price at any time is the collective result of the interaction of rational actors (that correctly discount all relevant information) with the irrational, noneconomic behavior of other investors. There may be times when a market is dominated by rational investors and other times when it’s driven by irrational behavior. For example, the great manias such as the Dutch Tulip Mania, the South Sea Bubble, and the Dot-Com craze are cited by behavioral finance proponents as examples of extreme irrational behavior. The problem, of course, is that it’s one thing to point out when a market wasirrational. After all, hindsight is 20-20. It’s another to predict when it will be irrational again. Timing is everything.

And this where the Gamma Global Macro Model’s “edge” comes into play. The Model uses a methodology that identifies whether rational or irrational behavior is dominant at a given time and predicts how these forces change over time. This allows the selection of investment strategies that are optimal for that environment.

Gamma Investment Research has identified three “phases” or “states” that broadly describe a market’s character at any point in time:

- The market price trades at a level consistent with the correct, rational discounting of all relevant information. Prices in this phase tend to respond predictably and proportionally to changes in economic fundamentals. Opportunities to generate alpha in a rationally-priced market are limited. Passive strategies (e.g., buying and holding the S&P 500) and security-specific strategies like stock picking are likely to outperform active directional macro bets.

- These are periods in which price strongly diverges from its rational “fair value” level due to behavioral biases that are often caused or reinforced by extreme expansions or contractions of liquidity (money, credit) or leverage. The irrational phase is characterized by sustained directional movements (“trends”) that can drive the price far from its fair value level. These are markets that are best suited for judicious use of leverage and directional macro bets.

- Hyperrational markets occur at the tail end of irrational phases when sentiment has not yet changed but the original factors that triggered the mania are beginning to wane. Hyperrational markets can be very volatile because the extreme valuation makes prices disproportionally sensitive to even small changes in fundamentals. Perversely, the safest AND most profitable trades are on the opposite side of the mania. Hyperrational markets can offer huge alpha opportunities. The problem is that few investors are psychologically suited to exploit them because they invariably involve going against an entrenched trend. How many investors were short the NASDAQ in August 2000 or loaded up on stocks in February 2009?

These states apply to multiple time horizons. For example, the short-term environment may be priced hyper rationally cheap, the intermediate might be rationally priced, and the long-term environment could be irrationally expensive. Markets are constantly transitioning from one state to another as new information arrives. The observed market price is simply the net result of the interaction of all of these states.

Tying it All Together

The Gamma Global Macro Model’s alpha “edge” is its ability to identify the dominant market state and apply those indicators that have historically been most accurate in predicting prices in that environment. In addition, the Model is extremely effective in adjusting the weight assigned to these indicators as the market environment cycles through the rational – irrational – hyperrational phases.

The biggest challenge to accurate forecasting is that the relationship between predictive factors and market prices varies depending on the phase that the market is in. For example, in a rational market a 1% drop in corporate earnings might cause a 1% drop in a stock price. In a hyperrational overvalued market, that same 1% drop in earnings might trigger a 10% drop in price. In mathematical jargon, the relationship between a factor and price is not always “linear” (proportional). The problem is that mathematical solutions to this problem often produce forecasting models that work well in one environment only to blow up spectacularly in another. Our research has developed an algorithm that overcomes this instability in a way that sharply improves forecast accuracy compared to conventional forecasting approaches.

The Gamma Global Macro Model uses a unique set of nonlinear equations that dynamically adjust the importance of the different forecasting indicators based on the phase that the market is in. This ensures that the model generates the highest risk-adjusted expected return forecasts regardless of phase. Most investment strategies are limited to one style such as technical vs fundamental, value vs momentum, trend-following vs countertrend, etc. The Model, in contrast, dynamically adjusts so that the strategy in use is optimal for the type of environment that the market is in. It is not limited to one investment style because no one style is appropriate for every market environment.

It is our belief that the Gamma Global Macro Model comes closest to modelling the dynamics of how actual markets work compared to the hundreds of other models and approaches that we’ve analyzed over the last 40 years. The rational – irrational – hyperrational concept provides a compelling explanation of the apparent contradiction between evidence supporting efficient markets and behavioral bias. We believe that our analytical framework combined with the Research’s ability to adjust strategies dynamically has resulted in one of the best alpha-generating strategies available.